The stupid amount of research and hostage taking that goes along with figuring out this mortgage thing is just more than I can take. If it weren't for the fact that it involves my money, I'd just do what I did in school and bullshit my way through the thing.

Unfortunately, that's not a viable option. And I apologize in advance for the dullness of this entry. To make up for it I plan on including pictures of adorable animals, as well as boobies and well-toned abs. Although you might want to bookmark this crap anyway just for it's own sake. It may help later.

Aaaaannnnddd, here we go!

|

| So wee! |

Over the past few weeks I've learned that it's a lot easier for me to come up with inappropriate acronyms for APR than to actually understand what it is.

Annoying Person Rant... Acute Paranoia Risk... Anal Penetration Rape...

Turns out it stands for the much more boring Annual Percentage Rate.

The APR as it pertains to mortgages is basically an estimate of what your loan will actually cost you on a monthly or yearly basis. It's not an exact science, but it is helpful when comparing mortgages.

For example:

Bank Slick approves you for a $100,000 mortgage at a 5% interest rate.

Bank Shady approves you for the same amount but at a 6% rate.

Seems like common sense to go with the first one, right?

|

| Pictured: Lack of common sense. Although that pic is pretty sweet.. |

$5,000 vs. $1,500

Suddenly Slick doesn't seem like such a great deal, eh?

APR's are good in that they can take these things into account. This prevents bank's from advertising insanely low interest rates, but then tacking on a bunch of extra costs and fees which drive up the total cost of the loan.

There's also a ton of APR mortgage calculators out there to help you figure things out.

In a nutshell, APR is a more accurate, black and white, formula to compare mortgages.

And now.. kitties!

|

| Not what I would have used for bra stuffing, but to each their own.. |

Discount points are a means for the buyer to lower, or buy down, the interest rate on their loan.

One discount point is generally worth 1% of the total loan. So with a $100,000 loan, the discount points are worth $1000 each.

Example: You have a $100,000 mortgage loan at a 5% interest rate. You buy two discount points for a total of $2,000. Assuming that each point lowers the interest by .25% you have now changed your interest rate to 4.5% for the life of your loan.

Discount points do pay off if you plan on staying in your house for a long time, and they're tax deductible, which is cool. But if you wind up moving only a few years after you buy, you won't see the savings.

Lenders love discount points because by receiving the cash up front, they don't have to wait on interest payments and it enhances their liquidity.

But what's the difference between buying discount points and just putting down a larger down payment?

I'll be happy to get into that. But first!

|

| Rawr! |

Both discount points and the down payment come out of your pocket immediately, so it's kind of hard to see the difference. But remember that discount points affect the rate of your mortgage, while a down payment affects the amount.

Rate vs. Amount

Stick with me here.

Your monthly mortgage payment is made up of three different components. Interest rate, loan amount, and term, (or length of your mortgage).

So, if you're staying in your home for a long time, buying points may be to your benefit as they lower the rates over the long term. If you'd like to buy more house, increasing your down payment will help to do that. It all depends on your situation. Although here's a point calculator to help figure things out.

|

| Oh my god. So F#$%ing adorable. Also, thirsty. |

An origination fee (sometimes called origination points, administrative fee, underwriting or processing fee), is the money the lender charges upfront for evaluating and preparing your mortgage loan. Generally used to pay for a credit report, attorney fees, document preparation costs, and notary fees.

Bullshit? Yes. But what else are you going to do? Pay for a house in full? HA!

Anyway, the origination fee is generally calculated into the percentage of the total loan, which brings us back to the APR.

Make sure you check that shit!

The interest rate isn't everything, comparing loan APRs is the best way to determine which is the better deal.

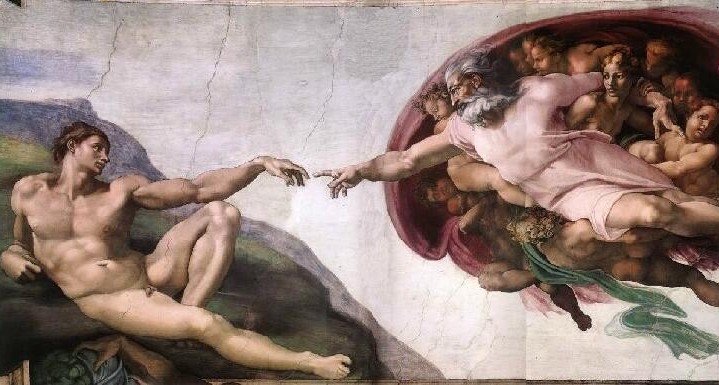

|

| I bet they have the cutest adventures |

So, after you've crunched the numbers, determined which loan is best for you, made an offer on a property, negotiated until you hate life, get your offer accepted and do an all too short happy dance, there are then closing costs to consider.

To help deal with it, here's more adorableness...

|

| *sigh* |

I think you see where I'm going with this...

Closing costs are made up of three categories. The cost of getting the loan, the fees involved with transferring ownership, and the taxes paid to state and local governments.

Generally, you can expect closing costs to be anywhere from 3-6% of your total loan. However, a lot depends on your location and the real estate market. And the list of closing costs is just silly.

Of course you could get the seller to pay for the closing costs, but you may wind up paying more for the property than if you had just been able to pay those costs up front.

If I've learned anything from this foray into mortgage lending, it's that "location, location, location" coincides with "depends, depends, depends".

There's just no telling what your mortgage situation is until your location, income, and a million other little things are factored it. So bring a pad of paper, a calculator and don't feel bad about making your lender explain things two or more times. With both examples and pictures.

You're the one who's going to be living with whatever plan you decide.

So good luck, and wish me some as well..

And now, please enjoy a piglet in boots.

|

| Wilbur! |